Financial success often seems like a mystery to working professionals, young adults, and entrepreneurs. However, simple rules can guide you. These 12 powerful personal finance laws help anyone manage money wisely and build wealth.

Law 1: Pay Yourself First

First, save or invest a part of your income as soon as you get paid. This step puts your financial goals first and avoids spending on wants. Eventually, saving early builds wealth.

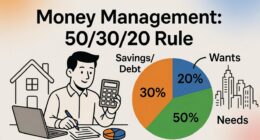

Law 2: Live Within Your Means

Next, spend less than you earn by creating a budget and sticking to it. This frees up money for saving and emergencies. In the long run, wise spending helps you avoid debt and build savings.

Law 3: Budget and Track Every Dollar

Moreover, write down every expense and track your spending with an app or notebook. It helps cut costs and free up more money for saving. In the end, tracking makes it easier to reach your goals.

Law 4: Use Compound Interest

Furthermore, start investing early to benefit from compound interest. Money you save now earns interest, and that interest earns even more interest. As a result, your savings grow much faster. In short, compounding is a powerful force for long-term planners.

Law 5: Avoid High-Interest Debt

Additionally, avoid loans or credit with high interest rates. Pay off expensive debts like credit card balances quickly. This saves money because high rates make debt grow fast. As a result, more of your income goes toward your goals.

Law 6: Multiple Income Streams

Also, build more than one way to earn money. Multiple streams provide security if one source slows down. Therefore, entrepreneurs often diversify income to protect against risk and grow wealth.

Law 7: Invest in Yourself

Furthermore, keep learning new skills or improving your education. Investing in knowledge increases your earning power. Taking courses or reading can lead to a better job or smarter investments. Personal development pays off.

Law 8: Diversify and Protect Assets

Moreover, never put all your money in one place. Invest in assets like stocks, real estate, and cash. If one loses value, others can grow. Hence, diversification protects savings from big losses. Insurance and an emergency fund are wise.

Law 9: Set Clear Goals

Next, define what you want to achieve with your money, such as saving for a home, retirement, or a business. Clear goals help you stay motivated and measure progress. Therefore, write down targets and review them often to guide every decision.

Law 10: Think Long-Term

Similarly, make decisions with the future in mind instead of quick fixes. Plan for the long term. Short-term gains can distract you. Thus, a long-term view keeps you steady during market ups and downs.

Law 11: Keep Expenses Low

Look for cheaper alternatives, such as cooking at home or using public transport. Living frugally instead of lavishly gives you more money to save or invest. Consequently, lower expenses mean faster progress toward your financial goals.

Law 12: Stay Disciplined

Finally, keep following these rules even when it feels hard. Continue saving each month and skip unnecessary spending. Track your progress and adjust as needed. Consistency and patience compound into success.